On 11 October 2019 YB Lim Guan Eng the Minister of Finance unveiled the Malaysian Budget 2020. One of the best things to do is to find a reputable and trusted accounting and tax services firm to help you comply.

Malaysian Tax Issues For Expats Activpayroll

With it you can also calculate contributions health pension and care insurance and taxes The calculator captures the calculation of the current 5 Withholding tax Its also can called monthly salary calculator for employees in a company in payroll Malaysia The spreadsheet has been updated to include the 2019 Budget announcement of an.

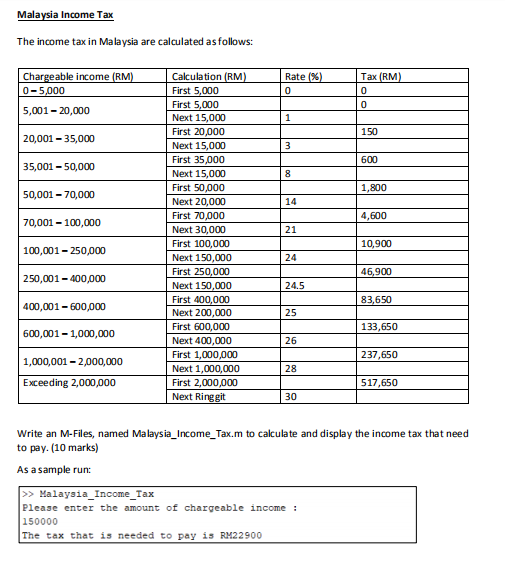

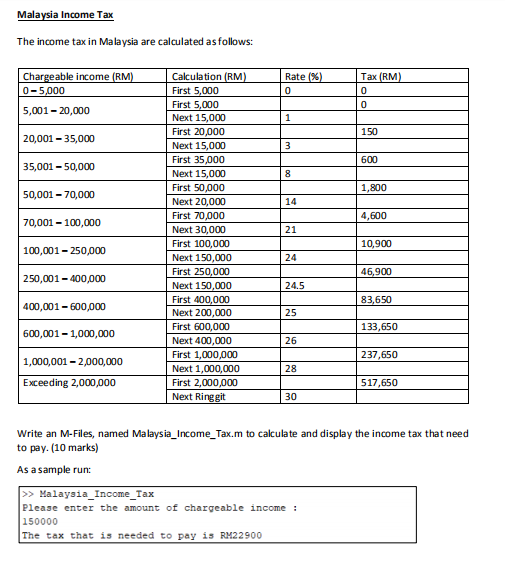

. There are also special rates for certain types of income such as dividends and capital gains. Too much math for you. In order to compute the yearly tax multiply income by the current tax rates.

Annual Taxable Income After Relief. As the taxable value is between 15 to 25 lakhs so that 5 will apply to income. If you live in Malaysia the following calculation will assist you in calculating your chargeable income.

For instance your salary is RM65000. The calculation of the income tax firstly depends on whether the individual resides in Malaysia or is not a resident of the country. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income.

Consider the following scenario. Chargeable Income Gross Income Tax deductible Expenses Tax Exemptions Tax Reliefs. The following equation will help you calculate your chargeable income in Malaysia.

Income taxes in Malaysia are designed to be territorial which means an individual or entity is taxed only on incomes earned. With our Malaysia corporate income tax calculator you will be able to get quick tax calculation adjustments that help you to estimate and accurately forecast your tax payable amounts. Chargeable Income is calculated as follows.

The citizenship or resident issue will be kept in mind while computing the income tax in the following ways. This amount is calculated as follows. Review the full instructions for using the Malaysia Salary After Tax Calculators which.

If you are not sure how to calculate income tax in Malaysia the good news is that you can find a wide range of guides and resources to help you. Malaysia Corporate Income Tax Calculator for YA 2020 and After. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

Expenses are equal to 6000 plus 2000 plus 10000 plus 1000 plus 1000 equals 20000. You can try to compute your taxes using our salary calculator. If you use a company vehicle the odds are you will pay a higher road tax in Peninsular Malaysia.

The PCB for each month may be calculated by dividing the yearly tax by 12 and multiplying the result by 12. Gross income minus expenses equals net income. The following equation will help you calculate your chargeable income in Malaysia.

In this example gross income is equal to 60000 minus 20000 40000. The calculator is designed to be used online with mobile desktop and tablet devices. Go on to the Malaysia income tax calculator to calculate how much tax you will have to pay.

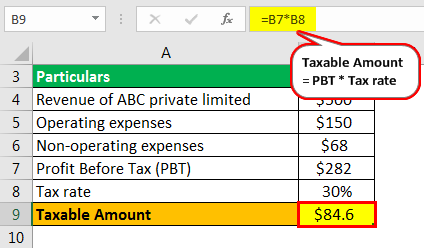

Total revenues minus total expenses equals net income. Annual Taxable Income Before Relief. Write the formula B2-B3-B4 inside the formula bar and press the Enter key.

The next RM15000 of your chargeable income 13 of RM15000 RM1950. Yearly chargeable income is calculated as total annual income minus available tax reliefs and deductions. Applying this formula on an actual figure for an example you will get this equation.

The individual will be considered as a tax resident of Malaysia for a year of assessment in the following situations. Gross Income minus Tax Deductible Expenses minus Tax Exemptions minus Tax Reliefs. RM55000 Gross Income RM9000 Taxable deductible expenses RM2000 Tax Exemption.

You are the one who does it. Taxable income is now extracted from gross income which is 219000. Taxable income is on which we apply the tax Tax is 5 on income below 250000.

Income tax in Malaysia is a progressive tax which means that the amount of tax paid increases as income increases. Tax Offences And Penalties In Malaysia. First RM50000 RM1800 tax Next RM15000 at 13 tax RM1950 Total RM3750.

This marginal tax rate means that your immediate additional income will be taxed at this rate EPF deduction is restricted to RM500 only any amount above RM500 is consider lost Find salary estimate base salary bonus total compensation competitive compensation jobs from leading job boards and useful Salary centreIncome tax calculatorIncome tax calculator Hourly. Heres an example of how to calculate your chargeable income. The vehicle use will also determine the road tax and it might also affect the result in.

04 hence your net pay will only increase by HK83 Net Distribution Calculator Your average tax rate is 21 You can calculate your salary on a daily weekly or monthly basis Tax Changes for 2013 - 2020 and 2021 Tax Changes for 2013 - 2020 and 2021. Total tax payable RM3750 before minus tax rebate if any However you dont have to memorise all this Simply use the income tax calculator in Malaysia that I recommended KiraCukaimy and itll automatically give your income tax guestimate. As an illustration consider the following equation when you apply this formula to a real-world figure.

RM - Monthly Tax Deduction PCB. 1 Sept 2018 MALAYSIA. Annual income hourly wage multiplied by the number of hours worked per week multiplied by the number of weeks in the year Replace your figures into this formula if you want to do it without using a yearly salary income calculator.

How To Pay Your Income Tax In Malaysia. Chargeable income also known as taxable income is your total annual income minus all the. Given the tax rates above you need to remit RM3750 at a rate of 13.

Chargeable Income Gross Income Tax deductible Expenses Tax Exemptions Tax Reliefs Applying this formula on an actual figure for an example you will get this equation. The method for calculating yearly income is as follows.

7 Tips To File Malaysian Income Tax For Beginners

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Everything You Need To Know About Running Payroll In Malaysia

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Solved Malaysia Income Tax The Income Tax In Malaysia Are Chegg Com

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Individual Income Tax In Malaysia For Expatriates

The Complete Income Tax Guide 2022

How To Calculate Income Tax In Excel

Calculate Your Chargeable Or Taxable Income For Income Tax

How To Calculate Income Tax In Excel

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

Malaysian Bonus Tax Calculations Mypf My

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Calculating Income Tax Payable Youtube

Cukai Pendapatan How To File Income Tax In Malaysia

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)